Business-as-usual is not an option anymore. This also applies to investment portfolios.

The challenge of our generation In the coming years, the global economy will need to undergo a profound transformation towards more sustainable products and services. The shift towards a CO2-neutral economy, particularly in response to climate change, represents one of the most significant challenges ahead. The goal of limiting global warming to 1.5 degrees Celsius, as set forth in the Paris Climate Agreement, is becoming increasingly critical.

The primary role of the financial sector is to support the transition towards sustainability by directing capital flows effectively. The motivations for investment are varied: investors may aim to minimize risks, capitalize on return opportunities, or contribute positively to societal goals.

Investors don't change the world, companies do!

Investor impact by capital allocation Investors often do not have a direct impact on real achievements such as the reduction of global greenhouse gas emissions. This does not imply that investors cannot have an impact in the first place, but rather that their impact on the real world is indirect – for example through investing in the companies which can indeed have a direct impact on the real world.

Market signaling as optimal way to go The chart on the right illustrates the two different levels of effectiveness: The impact of investors on companies & the impact of companies on the real world. Within this framework, we believe that, apart from engagement with invested firms, market signalling through capital allocation is the best and most efficient way to have an impact on companies and to substantially support the transition towards a more sustainable economy.

The Finreon Engagement Concept

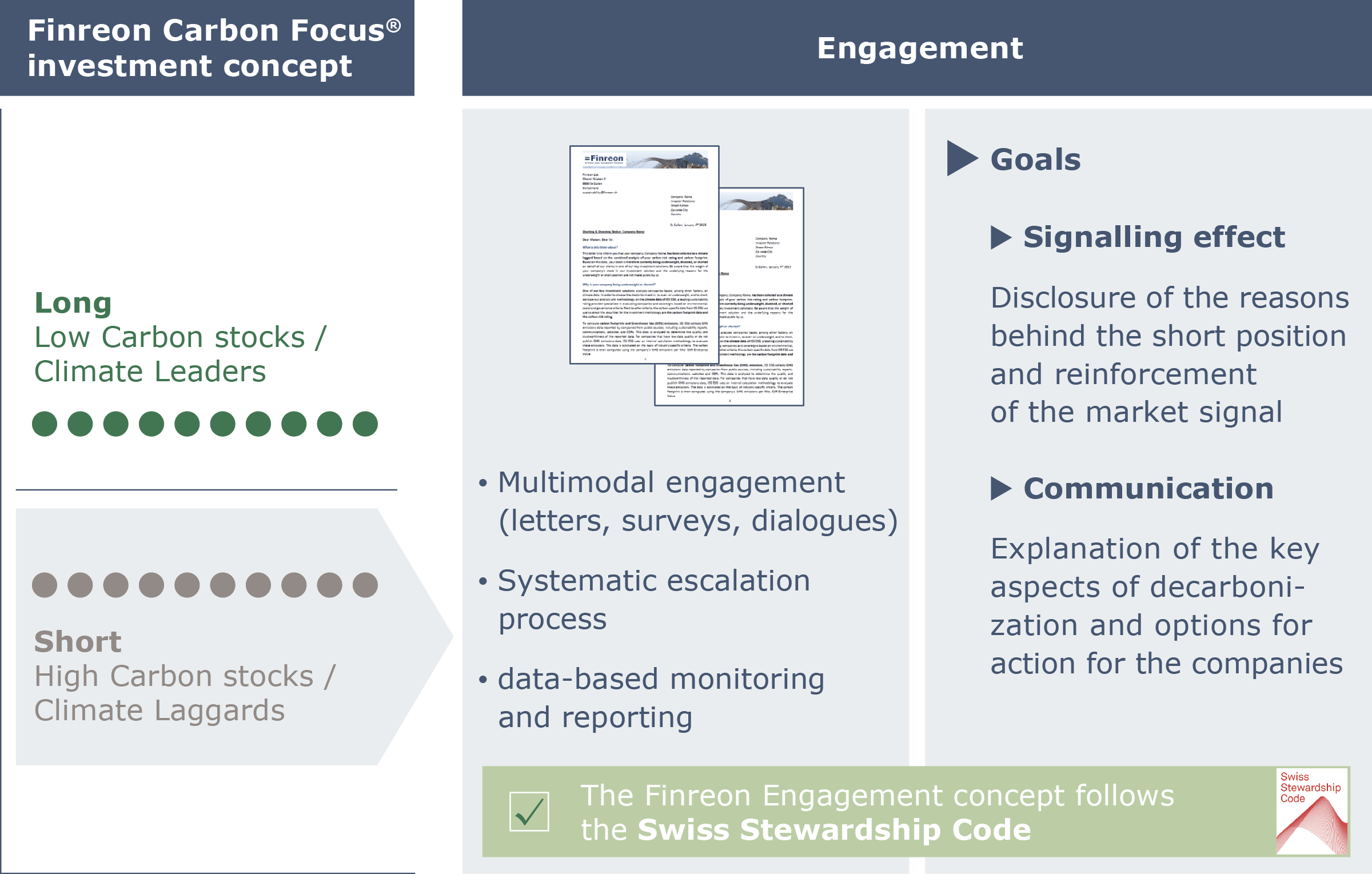

Pressure on carbon-intensive companies Finreon's engagement concept is an innovative form of engagement that amplifies the market signal generated in the Finreon Carbon Focus® investment solution. Within this solution, the most carbon-intensive global companies in each sector are selected and actively shorted. These companies, which produce very high greenhouse gas emissions, are proactively informed about this pressure as part of our engagement concept, so that we send a strong, constructive non-market signal in addition to the market signal.

Signal effect and monitoring Companies are informed about the short position and the reasons for it through various channels (letters, surveys, dialogues). Through this exchange, companies learn in a transparent manner about the CO2-related aspects that are important to investors and about available options for decarbonization. The companies are also monitored on a regular and data-based basis. If there is a sufficient, measurable improvement in their CO2 profiles, the companies can be removed from the short list.

Become part of the Finreon Engagement Pool!

Effective engagement with CO2-intensive companies As a participant in the Finreon Engagement Pool, you help to exert pressure on CO2-intensive companies globally and across sectors. Together, we are committed to sustainable change and promote transparent dialogue for a low-carbon future.

Numerous responses and constructive exchanges. One year after the launch of our initiative, numerous companies have already responded (see selected responses on the right) and taken part in our survey. We have also already entered into dialogues with focus companies.

Engagement reporting As a participant in the Finreon Engagement Pool, you get access to the annual Finreon Engagement Report, which provides detailed information on engagement activities. In addition to statistics on engagement, the engagement report also gives you detailed insights into the interactions with the companies.

The Finreon Engagement Report 2023-2024

The Finreon Engagement Pool generates numerous reactions: 89 (= 28.5% of the CO2 emissions of the World Equity Index) of the 235 shorted companies have responded to our engagement.

Learn more about the valuable insights of the last engagement cycle (2023-2024) in the Engagement Report of the Finreon Engagement Pool:

How can I join the Finreon Engagement Pool?

Memberships & labels

UN-PRI

As a signatory to the UN Principles for Responsible Investment (UN PRI), Finreon is committed to integrating ESG issues into its investment processes to the extent consistent with its fiduciary obligations. Finreon and its employees also strive to promote responsible behavior as part of their professional activities. For example, over 90% of employees use public transportation, ride bicycles, or walk to work. The same applies to the instruction to travel to customer appointments by public transport wherever possible. In addition, various measures are taken at both office locations to keep the ecological footprint as low as possible.

SSF

As a member of the SSF, we are committed to strengthening the advancement of sustainable finance and promoting climate change solutions within the financial industry, such as decarbonizing portfolios. We believe that financial institutions like ourselves have a responsibility to make their own positive contribution to the transition from a brown to a green economy, just like all other sectors of the economy. Our goal is to drive innovative solutions by bridging the gap between science and practice.

FNG

The FNG label is the quality standard for sustainable investments. One of the core tasks of the FNG is to further develop and improve financial investments in order to ensure the quality of sustainable investment products. The Finreon SGKB Carbon Focus® Fund has been awarded this coveted label for the year 2024. In the evaluation process, the strict selection and construction processes, the innovative engagement concept and the high level of transparency particularly stood out. Furthermore, the role of sustainability, as well as the ESG know-how and institutional credibility in our company were considered very positive.

Climate Action 100+

Climate Action 100+ is an investor-led initiative to ensure that the world's largest greenhouse gas emitters take the necessary action to combat climate change. Joining Climate Action 100+ is perfectly in line with our engagement concept for CO2-intensive companies, which we have implemented since January 2023. Joining Climate Action 100+ means that we are now joining forces with other signatories for company-related engagement, thereby further expanding our channels of influence.

Finreon Engagement Pool

Finreon's engagement concept is an innovative form of engagement that amplifies the market signal generated in the Finreon Carbon Focus® investment solution. This solution selects and actively shorts the most carbon-intensive global companies based on carbon data and forward-looking climate risk metrics. These companies are proactively informed about this pressure as part of our engagement concept, so that we reinforce the market signal with a strong, constructive non-market signal. The participants in the Finreon Engagement Pool contribute to exerting pressure on CO2-intensive companies across sectors and globally. Together, we advocate for sustainable change and promote transparent dialog for a low-carbon future.

Sustainability of Finreon’s solutions

Exclusions and active ownership In order to be able to fulfill its responsibility towards the environment, society and the economy in a holistic manner, Finreon strictly follows the guidelines of the Swiss Association for Responsible Investment (SVVK) in all its investment solutions. Furthermore, Finreon does not use derivatives on commodities such as agricultural products, energy products, trading goods or raw materials in its investment solutions. Finreon also proactively communicates and engages with CO2-intensive companies, which are selected based on our internal engagement concept.

Sustainable Solutions for the needs of our customers Finreon‘s sustainable solutions combine traditional approaches with sustainability criteria. Our solutions with ESG Focus integrate an activity- and norm-based exclusion strategy throught the investment process, a systematic integration of sustainability criteria throughout the portfolio construction, a best-in-class selection or a mix of these ESG strategies. The solutions with dedicated sustastainability focus integrate the mentioned ESG strategies as well but also pursue an explicit sustainability objective.

Standard

All Finreon solutions take into account the guidelines of the Swiss Association for Responsible Investments (SVVK).

ESG Focus

The Finreon SGKB Tail Risk Control (World) ESG invests in a sustainable and broadly diversified portfolio. The starting point for the equity selection is the sustainable global universe (Equities World ESG Leaders). In addition, the equity exposure of the strategy is controlled from 0% to 100% by the Finreon Tail Risk Indicator.

SPI ESG Multi Premia® combines seven different factor premia into a robust investment solution which is optimally diversified over Swiss equities and factors. Through the exclusion of critical sectors, the ESG integration and the stewardship approach, sustainable companies should be supported.

to the fundsite

Finreon Emerging Markets Equity IsoPro® invests in 175 of the largest sustainable stocks in the emerging markets. Sustainability and sector representativeness are ensured using a best-in-GICS-sector approach based on sustainability ratings from Inrate.

Sustainability Focus

Finreon Volatility Income® is an innovative, risk-controlled and sustainably designed volatility strategy with robust risk/return characteristics, offering steady returns and attractive diversification potential.

to the fundsite

Finreon SGKB Carbon Focus® combines a strictly sustainable equity portfolio with an innovative strategy to decarbonize the portfolio. With this strategy, which is registered for patent approval, a negative exposure towards CO2-intensive business models is established.

AMC Sustainability Champions is a structured product that invests in the most sustainable listed companies worldwide and is constructed in such a way that carbon neutrality can be ensured with the investment. The stock selection is based on the Finreon Carbon Focus® methodology and follows ESG standards.

to the fundsite

Contact us